Betting exchange apps

Betting exchange apps are a type of gambling app that allows users to bet against each other, rather than against the house. This can be a more profitable way to bet, as the odds are typically better.

This can be a more profitable way to bet, as the odds are typically better.

DBM Provides

A virtual sports app is a type of betting app that allows users to place bets on simulated sporting events.

Betting exchange apps can be a fun and exciting way to bet on sports. However, it is important to be aware of the risks involved before using them.

Works with iOS and Android

With two versions of Square Reader for magstripe—one for a headset jack, the other a Lightning connector—you’re covered. Just pick the credit card reader that works for you.

Get paid any way you like with the Square Point of Sale app.

What is a Virtual sports app?

A virtual sports app is a type of betting app that allows users to place bets on simulated sporting events. These events are generated by a computer algorithm and are not based on real-world sporting events. Virtual sports apps typically offer a variety of sports, such as football, basketball, and horse racing.

Benefits of using betting exchange apps

There are many benefits to using betting exchange apps:

Better odds

Betting exchange apps typically offer better odds than traditional bookmakers. This is because they do not have to take a cut of the winnings, as they are simply facilitating the bet between two users.

More control

Betting exchange apps give you more control over your bets. You can set your own odds and choose who you want to bet against.

More flexibility

Betting exchange apps are more flexible than traditional bookmakers. You can bet on a wider range of events and markets, and you can also bet in-play. .

NEED Betting exchange APP SERVICES

Innovate with mobile app solutions with us, reach us to get started

How to use betting exchange apps?

To use a betting exchange app, you will need to create an account and deposit funds. Once you have deposited funds, you can start betting. To place a bet, you will need to select the event you want to bet on and the odds you want to offer.

The global betting exchange apps market size is expected to reach \$3.2 billion by 2026, growing at a CAGR of 1

The Asia Pacific region is expected to be the largest market for betting exchange apps, accounting for 35% of the market share by 2026.

The North American region is expected to be the second largest market for betting exchange apps, accounting for 25% of the market share by 2026.

Why develop betting exchange apps?

There are many reasons why you might want to develop a betting exchange app. Here are just a few

To create a new source of income

Betting exchange apps can be a great way to generate revenue. You can charge users to download your app, or you can take a cut of the rake from each bet.

To reach a global audience

Betting exchange apps can be played by people all over the world. This means that you have the potential to reach a much larger audience than you would with a traditional betting app.

To stay ahead of the competition

The betting exchange app market is constantly evolving. If you want to stay ahead of the competition, you need to constantly innovate and improve your app.

Cost to develop betting exchange app

The cost to develop a betting exchange app can vary depending on a number of factors, including the complexity of the app, the features you want to include, and the development company you hire.

However, you can expect to pay anywhere from $50,000 to $200,000 or more to develop a basic betting exchange app.

Factors that can affect the cost of betting exchange app development

There are many ways that businesses can make money with a virtual sports app. Here are a few of the most common methods:

Complexity of the app

- The more complex the app is, the more it will cost to develop. This is because more complex apps require more features and functionality, which takes more time and resources to develop.

Features

- The features you want to include in your app will also affect the cost. For example, if you want to include features like live dealer games or tournaments, this will add to the cost of development.

Development company

- The development company you hire will also affect the cost of development. More experienced and reputable development companies will charge more, but they will also be more likely to produce a high-quality app.

Subscriptions

- Businesses can also charge users a subscription fee to access certain features or content on their virtual sports app. This could include things like live streaming of games or access to exclusive betting markets.

Affiliate marketing

- Businesses can also make money through affiliate marketing. This is when they partner with other businesses to promote their products or services. The business will earn a commission for every sale that is generated .

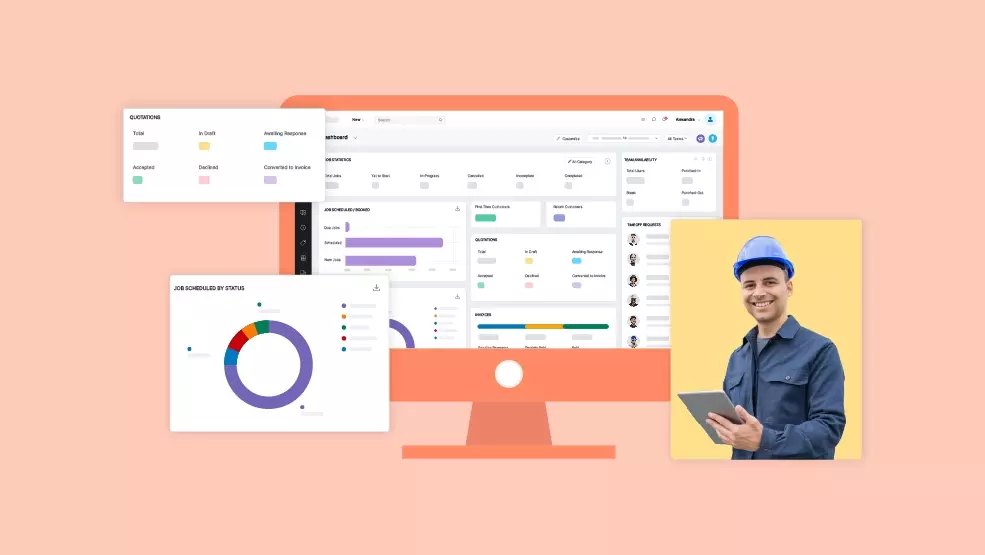

Easy integration

- The specific way that a business makes money from its virtual sports app will depend on the app's features, the target audience, and the business model.

Steps to develop betting exchange app

Here are the steps involved in developing a betting exchange app

Define the app's purpose and features

The first step is to define the purpose of the app and the features that it will have. This will help you to determine the scope of the project and the resources that you will need.

Research the competition

It is important to research the competition and understand what other virtual sports apps are available. This will help you to identify features that your app should have and to avoid features that are already being offered by other apps.

Choose a development platform

There are a number of different development platforms that can be used to develop virtual sports apps. The platform that you choose will depend on the features that you want your app to have and the resources that you have available.

Design the app

The next step is to design the app's user interface and user experience. This will involve creating wireframes and mockups of the app's screens and flows.

Develop the app

Once the design is complete, the app can be developed. This involves coding the app's functionality and integrating the different features.

Test the app

It is important to test the app thoroughly before it is released to the public. This will help to identify and fix any bugs or errors.

FAQ

Human Resource Management (HRM) service providers offer a range of HR-related services, including recruitment, employee onboarding, payroll processing, benefits administration, performance management, and HR compliance.

To pay with QR pay, customers simply need to open their QR pay app and scan the QR code displayed by the merchant. The customer's QR pay app will then open a new screen with the transaction details, such as the amount to be paid and the merchant's name. The customer can then review the transaction details and confirm the payment.

QR pay offers a number of benefits for both customers and merchants, including:

- Convenience: QR pay is a very convenient way to pay, as customers can pay for goods and services with just a few taps on their smartphone.

- Speed: QR pay transactions are processed very quickly, so customers can get in and out of stores faster.

- Security: QR pay is a secure way to pay, as QR pay apps use encryption to protect customer data.

- Cost-effectiveness: QR pay transactions typically have lower fees than traditional payment methods, such as credit cards.

QR pay is accepted by an increasing number of merchants around the world. Some of the places where you can use QR pay include:

- Retail stores: Many retail stores now accept QR pay, including grocery stores, clothing stores, and electronics stores.

- Restaurants: Many restaurants now accept QR pay, both for dine-in and takeout orders.

- Coffee shops: Many coffee shops now accept QR pay, so you can grab your morning coffee without having to fumble with cash or cards.

- Transportation: QR pay is now accepted on many public transportation systems, such as buses and trains.

- Online: QR pay can also be used to pay for goods and services online.

There are two main types of QR pay apps:

- Bank-issued QR pay apps: These QR pay apps are issued by banks and can be used to pay for goods and services using the funds in your bank account.

- Third-party QR pay apps: These QR pay apps are issued by third-party companies and can be used to pay for goods and services using the funds in your mobile wallet balance.

There are a number of factors to consider when choosing a QR pay app, such as:

- The features you need: Consider which features are important to you, such as peer-to-peer payments, bill payments, and loyalty programs.

- The fees: QR pay apps typically charge transaction fees, so compare the fees charged by different apps before you choose one.

- The security: Make sure to choose a QR pay app that uses encryption to protect your data.

- The merchant acceptance: Make sure to choose a QR pay app that is accepted by the merchants where you shop.

To set up your QR pay app, you will need to create an account and link it to your bank account or mobile wallet balance. Once your account is set up, you will be able to start using QR pay to pay for goods and services.

To pay for goods and services with QR pay, simply open your QR pay app and scan the QR code displayed by the merchant. The customer's QR pay app will then open a new screen with the transaction details, such as the amount to be paid and the merchant's name. The customer can then review the transaction details and confirm the payment.

Yes, QR pay is a safe way to pay. QR pay apps use encryption to protect customer data. Additionally, QR pay transactions are typically processed very quickly, so there is less time for fraudsters to steal your information.

QR pay apps typically charge transaction fees. The amount of the fee varies depending on the QR pay app and the merchant. However, QR pay transaction fees are typically lower than traditional payment methods, such as credit cards.

If you have a problem with your QR pay transaction, you should contact the customer support team of your QR pay app. The customer support team will be able to help you resolve the issue.